Zen Windows Makes Windows And Doors Easy

Find your ideal vinyl windows and doors by doing it the Zen Windows way!

Zen Windows Makes Getting New Windows And Doors Easy

Find your ideal vinyl windows and entry doors by doing it the Zen Windows way!

About Us

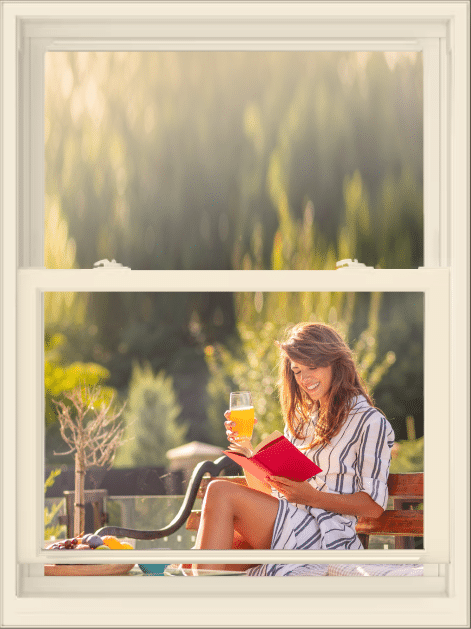

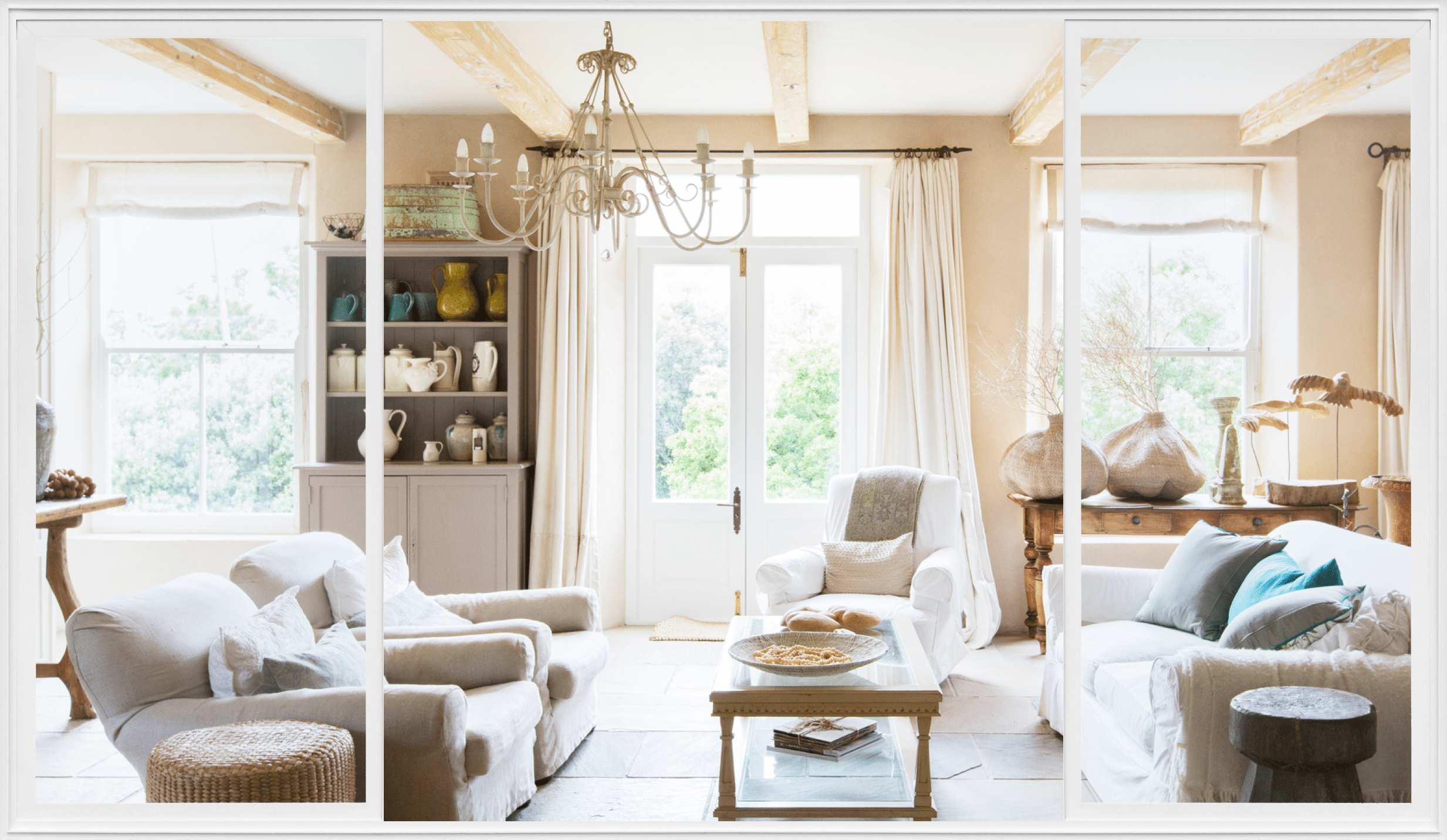

When you turn to Zen Windows, you’ll be surprised at how easy it is to replace your windows and doors. We combine timeless styles, high-quality materials, and energy-efficient designs to create products you’ll be proud to put in your home.

Who We Aren’t

Other companies try to upsell to push products that you don’t really need or want. At Zen Windows we are different…

No

pushy salesman

No

3 hour in-home presentations

No

money down

No

fake discounts

Who We Are

At Zen Windows our windows are transparent, and we believe the process should be, too. No hassle, no hard sell: just quality products.

Zero pressure

buying process

High-quality

products

Impeccable

customer service

Who We Are

When you turn to Zen Windows, you’ll be surprised at how easy it is to replace your windows and doors. We combine timeless styles, high-quality materials, and energy-efficient designs to create products you’ll be proud to put in your home.

Zero pressure buying process

High-quality products

Impeccable customer service

Who We Aren’t

Our windows are transparent, and we believe the process should be, too. No hassle, no hard sell: just quality products.

No pushy salesmen

No 3 hour in-home presentations

No money down

No fake discounts

Our Process

NEVER allow a window salesperson in your home!

Replacing your windows and doors with Zen Windows is easy…

Bonus Step

Warranty

Your windows are now covered by our Double Limited Lifetime Warranty that covers both labor AND materials.

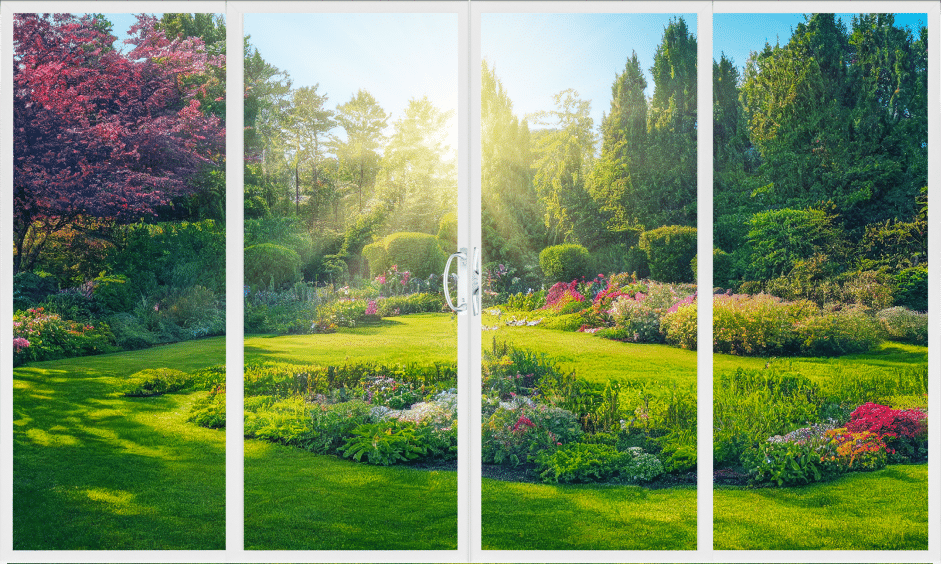

Products We Offer

At Zen Windows we pride ourselves on offering the best replacement windows and entry doors for your home, featuring classic designs, high quality materials and the best customer experience in the industry. All with no money down!

Reviews

Happy homeowners are our best advertisement. Learn why your neighbors trust Zen Windows.

I loved the ease of getting an estimate from Zen Windows without having to make an appointment or have someone come to my home with a high pressure sales pitch. The process was easy. The information I received helped me choose the windows I wanted and Zen was available with quick responses to any of my questions. I would recommend Zen windows to friends and family.

– Cindy K.

You only get new windows once so I wanted to make sure I did thorough research. It took me about a year to decide and I’m really satisfied and happy I went with Zen Windows. Beginning with their quoting process to the installation and service after, they’ve been extremely professional and responsive. I looked at all the other major brands and this window is extremely high quality and competitively priced. And I didn’t have to spend hours with some salesperson just trying to wear me down. Do your research and I think you will see this is an excellent company and product. I highly recommend Zen Windows.

– Steve P.

Zen Windows was amazing! They were so responsive and helpful through every step of the process. Pricing was extremely transparent and fair and the installation was so quick and clean. We have had no issues whatsoever and love our new windows! Definitely recommend Zen Windows for your next project!

– Kate F.

Ready to get started?

The Zen Windows team wants to ensure you have the information you need to make the best choice for your property. We can go over design trends and help you select the right windows that complement the architecture of your property and meet your expectations. Whether you’re looking for windows or glass doors, we will help you find products that fit your home and your life. Please select a product category and get started with Zen Windows today!

Change how you see the world from your home when you work with Zen Windows. We revolutionized the way homeowners purchase windows, and have the reputation to prove how successful we’ve been in improving the process.